Greece : what is the current situation ?

For a month, the situation in Greece and Europe has been stabilized. It's time to do an inventory of the situation.

After an agreement between the EU and Greece, Alexis Tsipras held a referendum on July 5th, 2015.

The Question was : "Should we accept the Plan Agreement submitted by the EC, the ECB and the IMF during the Eurogroup of 25 June?"

Result : 61.31% "no" (Participation : 62.5%). Greek people refused an agreement which imposed further austerity, this was an agreement supported by Alexis Tsipras contrary to what he pledged late January 2015.

After further negotiations and despite the referendum, Greece finally agreed with austerity coupled with an additional european help in order to meet its future deadlines and a future negotiations for debt restructuring.

1 - What is the Greek financial current situation ?

- see a blog post published in March 2015

- banks have been recapitalised in 2013 and 2014, but they must be recapitalised again : the flight of capital during the second half of 2015 has caused a capital control in June ; according to the EC, in July banks would need 25 billion Euros ; the EC has added that the EU must intervene because Greek banks have subsidiaries in other European countries and in some other countries close to the EU : Cyprus, Bulgaria, Romania, United Kingdom, Albania, Serbia, Turkey (sometimes up to 15-25% of the local system according to the EC)

- The debt level has deteriorated significantly : according to Lemonde.fr, in 2014, the forcast of a debt / GDP ratio was up to 125% in 2020 and 112% in 2022 ; however, considering the current economic outlooks drawn in July 2015 that show a glimpse at half-mast growth in 2015 and 2016, the debt / GDP ratio would rise to 165% in 2020, 150% in 2022 and 111% in 2030.

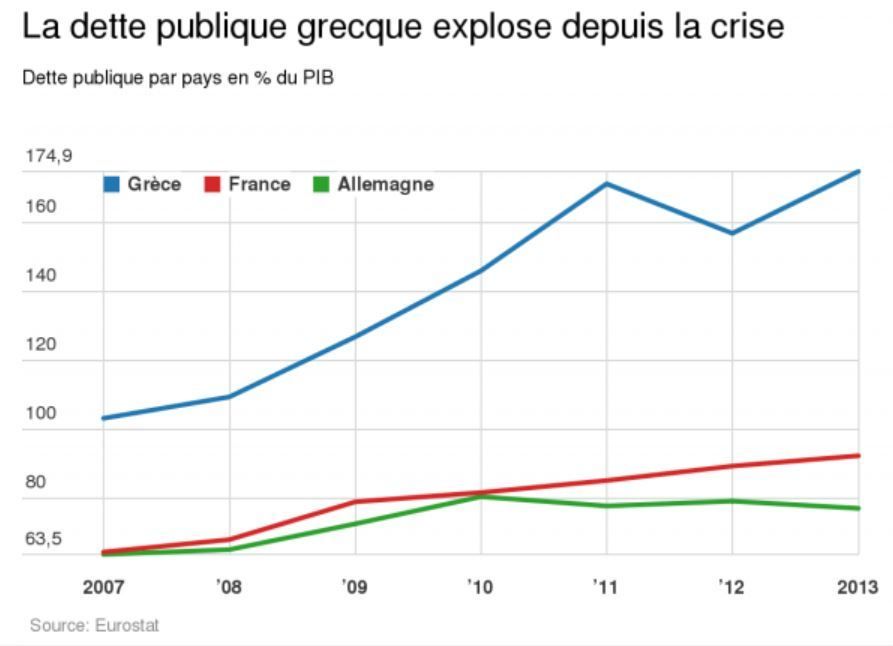

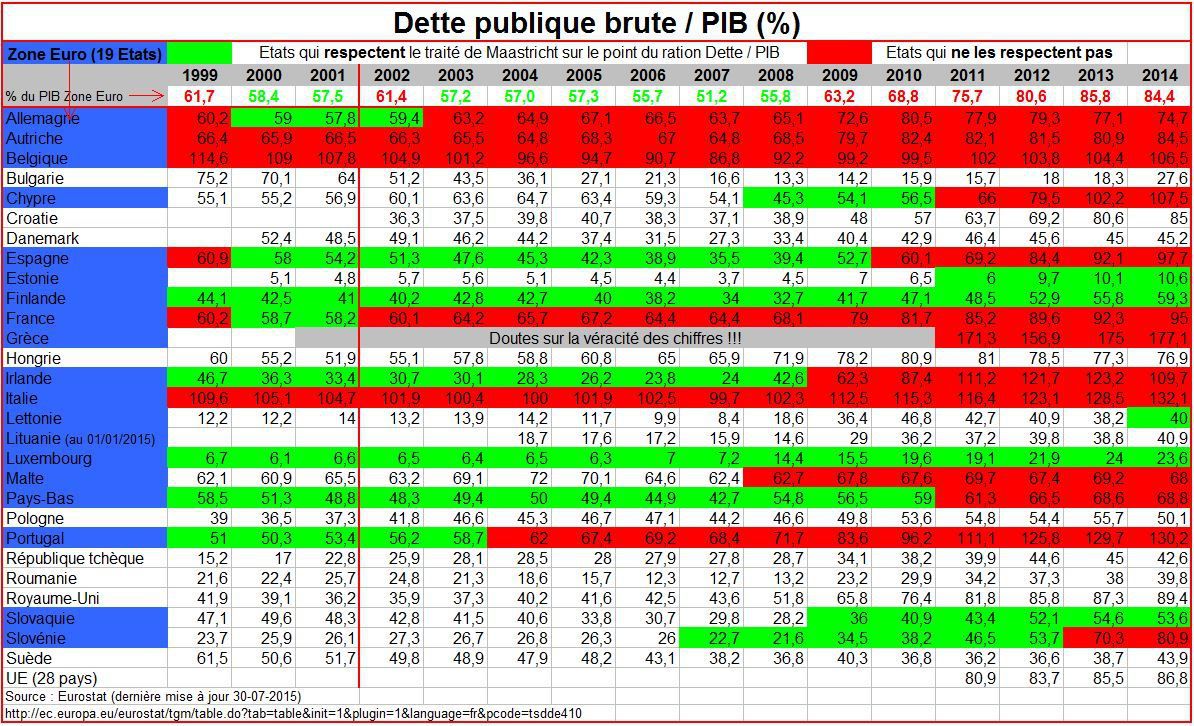

The following graphs show the situation of the 28 Member-States regarding the debt level.

What is to be known is that the Maastricht Treaty, which created the Euro on 1st January 1999 (Euro have been circulating from 1st January 2002), imposes a maximum debt of 60% of GDP. Upon the creation of the EU, only 11 Member-States adopted the new currency, 18 in 2014, the last country which has adopted Euros is Lithuania in 2015.

Could it be said that the debt level criterion, 60% debt to GDP, is clearly not a mandatory requirement ? In1999, 6 out of 11 countries do not respect this rule (3 of them were beyond 61%). Since then the number has continued to increase, reaching in 2014, 13 out of 18. It is to be noticed that a large majority of the new Member States entering the Euro zone since 2007 have met the criterion.

Considering the average debt of the Euro Zone regarding the GDP, until 2008, it was close to 60% and mostly below this "fateful" bar. The financial crisis and the sovereign debt crisis blew up the rule the Member States had fixed.

Among the largest economies (70% of EU GDP), 3 countries out of 5 (France, Italy, Spain) are among the countries that do not respect the criterion, they have a debt near or beyond 100 % of GDP from which, according to some economic experts, it is difficult to get out of the spiral of debt ; the only country clearly below this symbolic threshord is Germany.

In the Euro Zone, the only countries that still meet this criterion are : Estonia (11%), Finland (59%), Latvia (40%), Lithuania (41% in 2014 before adopting the Euro), the Luxembourg (24%) and Slovakia (54%). Indeed, more generally, we can say that the Member States that joined the EU in 2004, mainy the part of Europe under the yoke of the USSR, respect the 60% debt to GDP.

2 - What is the agreement?

2.1 - What has happened after the referendum?

A fortnight discussion tension period.

- Resignation of the Greek Finance Minister, Mr Varoufakis ;

- Phone conference of European leaders, Jean-Claude Juncker, President of the European Commission, Jeroen Dijsselbloem, Eurogroup President, Donald Tusk, President of the European Council and Mario Draghi, head of the European Central Bank (ECB) ;

- The meeting of the Euroworking Group : body composed of treasury directors of the 19 countries of the Eurozone whose role is to prepare the meetings of the 19 ministers ;

- The Governing Council of the ECB decided to delay their decision wainting for political decisions, and to grant emergency liquidity aid to Greek banks to prevent their bankruptcy ; at the same time it decided to "toughen the conditions for granting" of these aids ;

- The summit of Finance Ministers of the Eurozone : Greek new minister Tskalotos Euclid, came without reform proposals ;

- The summit of Heads of State of the Eurogroup, they decided to wait up to Sunday ;

- Sunday : cancellation of the European Council (28 States), the summit of the Heads of States of the Euro Zone only occured (20h negociations).

- Monday, July 13 an agreement is reached.

2.2 - Why was the agreement so hard to be found?

- Member-States were reluctant to grant additional aid to Greece (see map below) :

- countries felt they had made the necessary efforts to satisfy the constraints the EU council set concerning deficits to resolve their economic problems, they did not feel they had to make further efforts for Greek ;

- some countries have a standard of living below the Greek one, they did not want to provide more funding to Greece ;

- Germany, like other member states, made the necessary efforts, moreover, Merkel promised during the last German elections that Greece would not cost anything more to German taxpayers.

- Some other Member-States continue to advocate for reaching an agreement and avoiding the Grexit (see map below)

2.3 - What is the agreement that avoid Grexit ?

- The Greek commitments :

- before mid July :

- the independence of the Greek statistic agency (it provided incorrect figures to the EU before the crisis) ;

- compliance with EU rules on budget deficits ;

- actions to prepare the reform of pensions : 67 years in 2022 ;

- a VAT increase of the normal rate, up to 23% ;

- tax reform ;

- before the end of July :

- adoption of civil code procedures to accelerate the civil justice system and reduce costs ;

- the transpositon of a European directive into law on bank bailouts (called "BRRD") ;

- forward :

- the creation of a fund to privatize 50 billion privatization : 50% to bank restructuration and 50% to debt service and investment ; it will be managed by Greece under the gaze of the EU ;

- a reform of the internal market following the recommendations of the OECD (including for example legislation on the opening of shops on Sundays, on sales periods, pharmacies, bakeries, etc.) ;

- the privatization of the electricity transmission network ;

- a reform of the labour market ;

- the strengthening of the financial sector ;

- the cancellation of the measurements taken by the Tsipras government which reconsider previous Greek government commitments before the EU.

- before mid July :

- In against part, the EU will :

- pay 7 billion Euros to allow Greece to repay upcoming deadlines ;

- open negotiations for an extension of loans more than 80 billion Euros over 3 years via the ESM (European Stability Mechanism)

- study a debt restructuring, but once confidence is back.

2.4 - What will happen next ?

The Greek Parliament accepted the agreement and a number of national parliaments (France, Germany ...) will also have to decide.

Meanwhile, the EU will grant an emergency aid to Greece waiting for the agreement acceptance process is completed. Indeed, not only the ratification process in Member-state Parliaments but also their positions on the agreement are different.

Votes of some Member-states Parliament :

- Greek Parliament : 229 for - 64 against - 6 abstentions

- German Parliament : 439 for - 119 against - 40 abstentions

- French National Assembly : 412 for - 69 against - 49 abstentions - At French Senate: 260 for - 23 against.

- Finnish Parliament approves the agreement

- Austrian parliament approves agreement

- The Spanish parliament is expected to decide by mid-August

I did not find the results of votes in the other Member States.

3 - Some critical points of view

- Reach 50 billion Euro privatization seems to be totally inaccessible, according to lemonde.fr, this amount had already been planed in 2010, yet only 3.5 billion were realized.

- Failure is partly due to Angela Merkel, the German Chancellor, but also to the entire EU, according to tribune.fr.

- The restructuring of Greek debt is inevitable, according to Céline Antonin, a specialist on Greece at the OFCE (Observatoire Français des Conjonctures Econoqiques - French Observatory of Economic Conjunctures) interview published in Challenges.fr.

-------------------------------------------------------------------------------------------------------------------

Sources :

- La BCE maintient les banques grecques sous perfusion - Lemonde.fr - 06-07-2015

- L’Europe se fixe une « ultime date butoir » pour décider du sort de la Grèce - Lemonde.fr - 07-07-2015

- L’inquiétant tableau de la situation économique et financière grecque - Lemonde.fr - 11-07-2015

- L'objectif de 50 milliards d'Euros de privatisations à nouveau imposé au Grec - lemonde.fr - 15-07-2015

- Ce que la Grèce a accepté en contrepartie de l'aide financière - lemonde.fr - 13-07-2015

To go further :

- An article on this blog - March 2015

- Infographie : l’accord sur la Grèce reste soumis au vote des Parlements - Lemonde.fr - 13-07-2015

- Les échéances après le 20 juillet 2015 - Lemonde.fr - 18-07-2015

- les critiques vues par latribune.fr - 07-07-2015

- l'excellent dossier de France Culture.

- la restructuration de la dette est inéluctable - Challenges.fr - 01-07-2015