Juncker's plan for investments in the EU : how will it work ?

/image%2F1045670%2F20141203%2Fob_4bd72e_images.jpg)

On November 26th, Jean-Claude Juncker announced to the MEPs a plan of 315 billion Euro to boost investments in the EU.

Priorities would be given to national projects in the fields of transport, energy and digital economy.

Principle :

- Creation of a EFSI (European Fund for Strategic Investiments) managed by the EIB (European Investment Bank);

- The EFSI will have the following financial resources (21 billion euros globally) :

- it will get 5 billion Euros ;

- the EU budget will provide a guarantee for the remaining 16 billion Euros.

- After the Juncker'request, the Member States have already listed about 800 national projects that the EIB could contribute to, the best projects presented by the Member States would be taken on ;

- Part of the money would be directed towards helping SMEs.

What these 21 billion Euros should ?

- the 21 billion Euros authorize the EIB to borrow up to 60 billion Euros (to keep its rating, the AAA from the rating agencies, and thus keep a relatively low rate);

- The guarantees provided by the EU would reassure private investors who may be involved even if there were random profitabilities ... and public investors could invest too. So, according to Jean-Claude Juncker the plan will reach 315 billion euros over 3 years, especially as private abundant liquidity in the market are looking for investments ;

- Creation of 1 000 000 to 1 300 000 jobs over 3 years.

Positions completely published from euractiv.com :

"It's in everyone's interest to see stronger economic growth in Europe so I welcome the focus in today's proposals on reforms to raise growth prospects across Europe and the emphasis on increasing private sector investment,” said UK Chancellor of the Exchequer, George Osborne.

"In particular, specific steps on structural reforms to complete the single market and improve the incentives for investment are essential for Europe's competitiveness and prosperity, and are a longstanding priority for Britain," said Osborne.

In the run up to today's announcement, President Juncker's growth plan has attracted widespread scepticism from analysts who doubt it can address Europe's post-crisis investment woes. CEE Bankwatch Network, an NGO which monitors the activities of international financial institutions, said: "Big investment talk based on a leverage ratio of 15 to 1 is optimistic to say the least, if not irresponsible."

"In order to attract private investors the fund will only be used to ‘de-risk’ investments in risky projects that face difficulties attracting capital," Bankwatch noted. But "de-risking does not mean risk disappears, but rather that risk is passed on to public institutions and EU taxpayers," it warned.

“What looks at first sight like a big, new silver bullet to finance large infrastructure projects could very easily end up having a devastating effect on Member State budgets and the economy if the projects fail,” said Xavier Sol, director of Counter Balance, a European coalition of development and environmental NGOs. “Instead of blindly cheering a new source of cheap money we should be a bit more careful in assessing the solidity of this scheme and the clear risks that accompany it.”

Manfred Weber MEP, Chairman of the EPP Group in the European Parliament said : “We have made the promise that the citizens of Europe will be central to everything we do here. This is what the investment plan is about: boosting growth, creating jobs, adapting our economies to the challenges of the 21st century. The EPP Group strongly supports the European Commission’s investment plan presented today.”

Gianni Pittella the president of the Socialists and Democrats Group stated :

"The paradigm has finally changed. From the blind austerity dogma of the Barroso era, we are now moving to a new phase focused on investment, jobs and growth. This is just the beginning of this necessary process but we are at a turning point. Member states contributions to the new investment fund will now be deducted from the calculations of their deficits and national debts. We broke the taboo of rigidity. It is not about breaking the rules, but rather about the need for member states to count on flexible rules being applied in an intelligent way. This is the clear outcome of our political battle. The S&D Group fought hard for that and we can now be proud of this achievement."

Commenting on the European investment plan presented in the European Parliament today by European Commission president Juncker, Greens/EFA co-president Philippe Lamberts stated :

"There is thankfully widespread agreement that the European economy needs a shot in the arm but the investment plan proposed by president Juncker lacks ambition, means and clear goals. In terms of ambition, the headline €315 billion sum is clearly wishful thinking. The plan relies on wildly unrealistic projections on the ability to leverage private investment; it is hampered by the low level of public investment and the doubts as regards whether many of the funds are fresh or merely recycled existing commitments. Reallocating €21 billion of already committed funds will not mobilise €315 billion: a leverage effect of 15 is not serious."

The ALDE Group welcomes the Investment proposal by the Commission. ALDE President Guy Verhofstadt said : "First, we do not need public money, we need a serious guarantee scheme behind the fund. Not only the European budget and the EIB should be participating in this but also the European member states must be on board. This will ensure a credible guarantee scheme that turns around 100 billion and ensures a funding of investments of around 600 /700 billion."

"Secondly, we need to secure an interesting return on investment. The best solution for this is a tax exemption on the interest that this fund creates. This will attract not only institutional investors but also ordinary Europeans."

The League of European Research Universities (LERU) regrets "that money from Horizon 2020, the EU's successful research and innovation programme, will be diverted to the European Fund for Strategic Investment (within the European Investment Bank), for a vague and highly uncertain project. In the midst of 2014/2015 EU budget discussions between the EU institutions, which are already very threatening for Horizon 2020 and its awarded budget, this is a new subversion of the most important EU funding source for research and innovation. It should be clear for the EU institutions and the member states that Horizon 2020 is not a lemon which can be squeezed according to the flavour of the day! "

Social Platform warns that the European Social Model will not survive unless a serious commitment is made to invest in ambitious and integrated social policies.

“We are still missing investment in social policies within the package that go beyond job creation and job access. Social investment is vital for both social and economic prosperity, and for achieving growth that is not only smart, but also inclusive.”

Bernadette Ségol, General Secretary of the European Trade Union Confederation (ETUC) said : "I salute any attempt to increase investment which would bring jobs, but I do not believe Mr Juncker can raise €315bn from €21bn. The European Commission seems to be relying on a financial miracle like the loaves and fishes. Raising €315bn would be quite a feat, but would fill less than 40% of the annual investment shortfall since the crisis. I am not holding my breath for a major impact on growth or unemployment. A lot more will be needed to get Europe’s economy moving. I urge European Governments to boost the investment effort.”

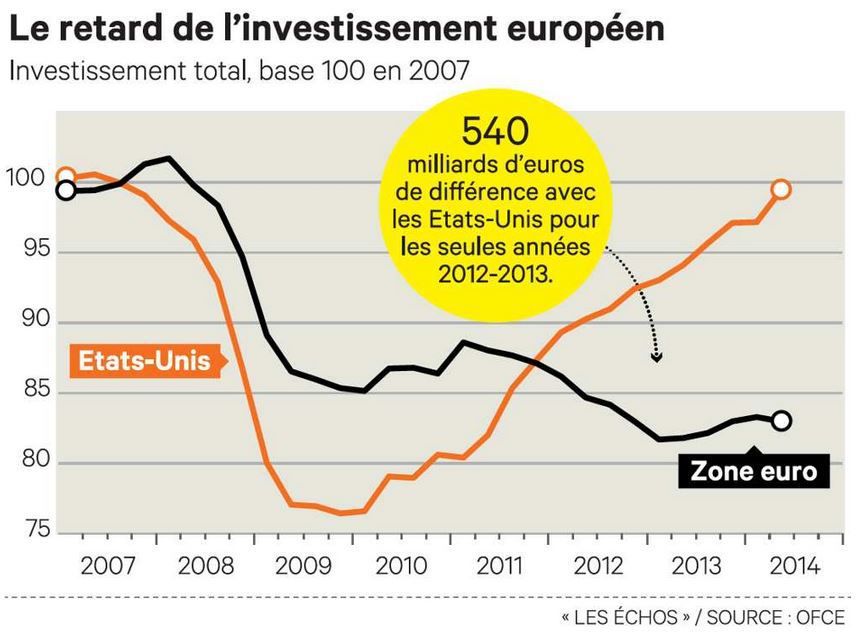

- Les Echos, a French newspaper : the investment gap is very important. In order that such investments would be effective for employment, we must stop the "sprinkling of structural funds" given by the EU.

Next steps :

- December 16th and 18th: At the European Council, now chaired by Donald Tusk, the Heads of State and Government will discuss the project of the European Commission ;

- Amendment of the draft EU budget and vote by the European Parliament as soon as possible so that the plan could be operational by June 2015.

--------------------------------------------------------------------------------------------------------------------

Sources :

- Un plan de 315 milliards d'Euros pour relancer l'investissement en Europe - LeMonde.fr

- Le plan Juncker veut réamorcer le flux des investissements en Europe - La-Croix.com

- Juncker's €315bn investment plan unveiled: fifteenfold leverage and solidarity for the south - Euractiv.com

- Le plan Juncker fait la part belle à l'investissement privé - LesEchos.fr

- Un fonds de 315 milliards d'euros pour relancer l'Europe - LeFigaro.fr

- Investing €315 billion to jump-start the EU economy - European Parliament

To know more :

- EC documents.

- Bruxelles annonce ce mercredi un plan de relance de 300 milliards d’euros pour doper la croissance - Libération.fr

- Les projets de la France - LeFigaro.fr